Nordic payments -

a rapidly changing landscape

Payments have always evolved, but never at the pace we see today

Smartphones and connected devices have brought ease, speed, and convenience to our daily lives. They’ve transformed the way we spend and manage our money.

Open Banking regulation has allowed fintechs and other innovators the opportunity to develop seamless, digital first payment experiences, which have changed our expectations of what great feels like.

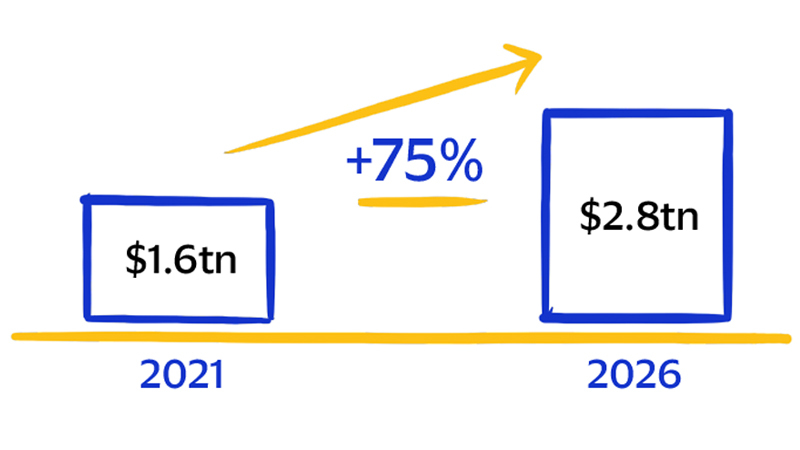

So, it’s no surprise to find that European ecommerce is booming – a trend that’s here to stay. By 2026, the European ecommerce market is set to reach $2.8tn, 75% higher than 2021 levels.¹

-

-

This graph depicts the total size of the European ecommerce market in 2021 vs 2026. It shows that it's expected that the ecommerce market will increase from $1.6 trillion in 2021 to $2.8 trillion in 2026 - a 75% increase.

As a result, there will be growing opportunities for continued innovation to better support SMBs and their customers.

Consumers have more choice than ever before

Digital wallets are now the most popular digital payment method, accounting for nearly 30% of all ecommerce spend.¹ This is particularly the case amongst Gen Zs, with 80% of 18-24 year olds already comfortable using them.²

We are also seeing strong growth in Buy Now Pay Later (BNPL) adoption. This payment method now comprises 10% of ecommerce spending³ and 30% of European consumers have already used it.¹

-

-

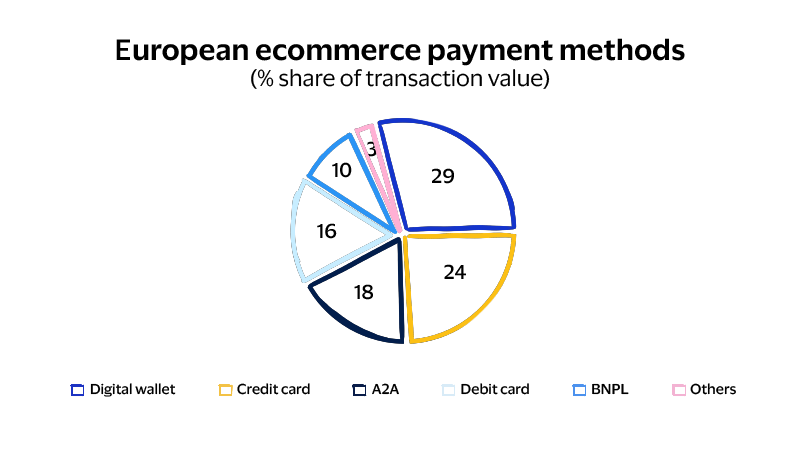

This image displays a pie chart with six segments. It shows the % share of transaction value for 6 different types of European ecommerce payment methods.

Digital wallet - 29%, Credit card - 24%, A2A - 18%, Debit card - 16%, BNPL - 10%, Others - 3%.

But there are obstacles to overcome

Fraud is a key challenge to future ecommerce growth

The shift to digital has also created an opportunity for fraudsters, who are eager to take advantage of vulnerabilities they find in the market.

Across Europe, digital fraud is having a significant impact, with the average fraud rates for card not present (CNP) transactions 10 times higher than those seen in the face-to-face (F2F) environment.⁵

Globally, the most common digital fraud types include phishing, which involves duping individuals to share sensitive data, and clean fraud, where they use stolen data to make a purchase look genuine.

Checkout friction is a threat to merchant sales

To help mitigate the risk of fraud and to verify the consumer is who they say they are, the industry has rolled out the use of Two Factor Authentication (2FA).

This means consumers must either memorise (multiple) passwords or use a one-time passcode sent to their device. As a result, across Europe, the average time taken to complete checkout now exceeds 3 minutes.⁶

This is having a significant impact on cart abandonment, especially as 62% of consumers have indicated they are likely to give up on a purchase when checkout takes longer than 2 minutes.⁶

The Nordics are an ecommerce success story

Their impact on European ecommerce is significant

In 2022, the Nordic ecommerce market reached $109bn³ – more than 7% of European ecommerce, despite only making up less than 4% of the European population.

Sweden and Denmark are leading the way

Businesses are embracing Open Banking

In Sweden alone, there are more than 150 third-party providers leveraging Open Banking capabilities today⁷, helping to deliver new, innovative banking and payment experiences.

Nordic consumers have rapidly adopted BNPL solutions

Nearly 50% of consumers have used it in the last 6 months¹ – 20pp higher than the European (ever used) average.¹

Even more impressive is that in Sweden, BNPL represents 24% of total ecommerce spend – the highest anywhere in the world.³ This is closely followed by Norway at 18%.³

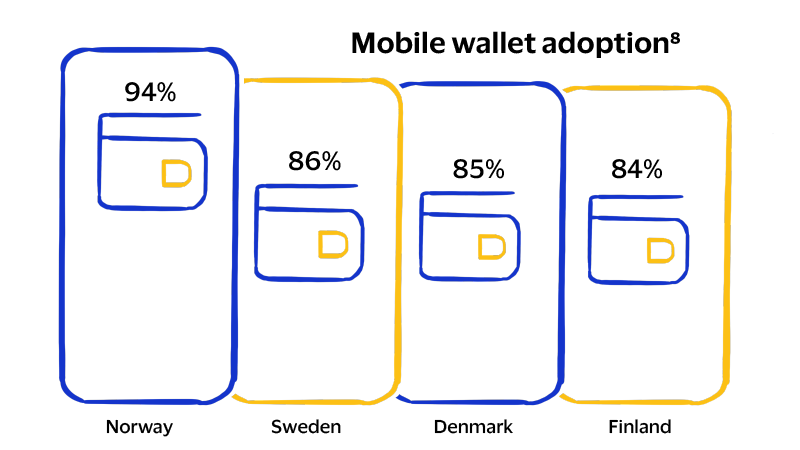

Digital wallet adoption exceeds 80% in each Nordic region

-

-

This graph shows the top four countries in the Nordics for mobile wallet adoption.

Norway – 94%, Sweden – 86%,

Denmark – 85% and

Finland – 84%.

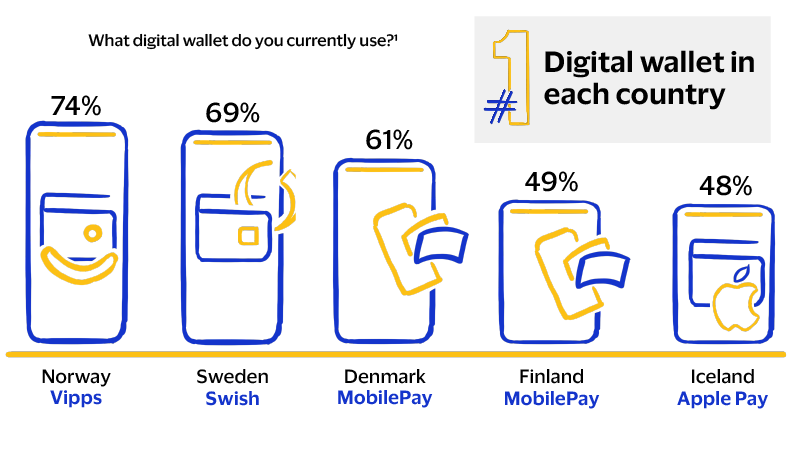

This is largely due to the popularity of domestic wallets

In Norway alone, nearly 75% of consumers use Vipps, while Sweden closely follows, with 69% of consumers using their domestic solution, Swish.¹

-

-

This graph illustrates the most used digital wallets in each Nordic country. In Sweden Swish is the most popular reaching 69% of Swedish consumers who have used it. In Norway, Vipps is most popular reaching 74%. For Denmark and Finland, MobilePay is used most at 61% and 49% respectively. For Iceland, Apple Pay is the most popular wallet reaching 48% of Icelandic consumers who have used it.

-

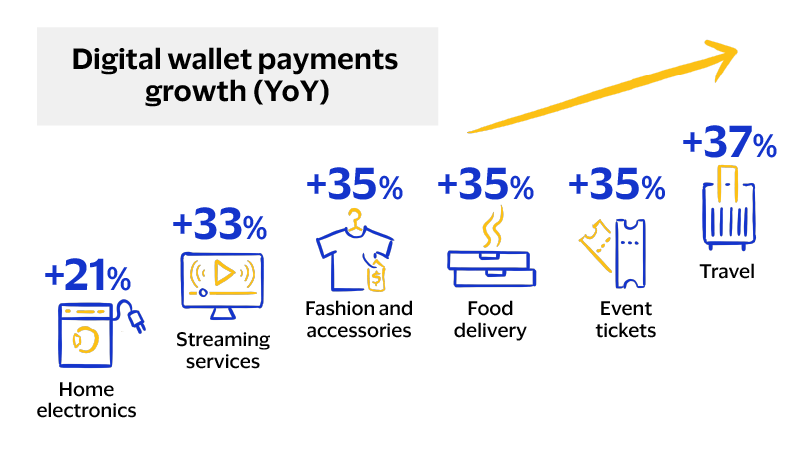

-

This graph shows the year-on-year growth in using digital wallets as a payment method by sector. 21% increase in digital wallet usage for Home Electronics, 33% increase for streaming services, 35% increase for fashion and accessories, 35% increase for food deliveries, 35% increase for event tickets and a 37% increase for travel related purchases.

As the likes of Apple Pay, Google Pay™ and more continue to be rolled out across the Nordics, digital wallets usage is set to increase further.

Iceland is a great example. Here, Apple Pay is the most popular wallet used and penetration rates are very high, reaching 29% of all ecommerce spend.¹

Further evidence of the rising popularity of digital wallets can be found when looking at usage in specific sectors. In travel, fashion and accessories, streaming services, event tickets and food delivery, growth rates all exceed 33%.¹

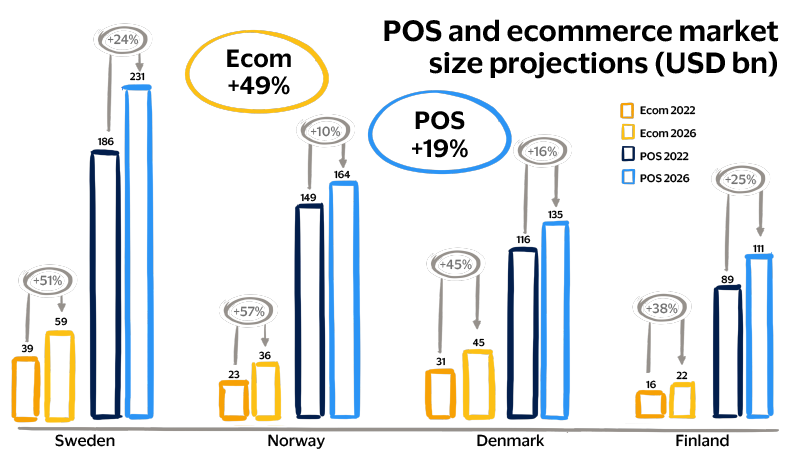

Nordic ecommerce is set to grow a further 49% by 2026

The future is bright for ecommerce in the Nordics. Market growth is expected to be nearly 3 times faster than F2F.³

Similarly, as digital wallets become more widely available, we expect to see continued adoption and growth in usage. In Europe as a whole, the forecasts are for nearly 200m more active users, reaching a total of 580m by 2025.¹

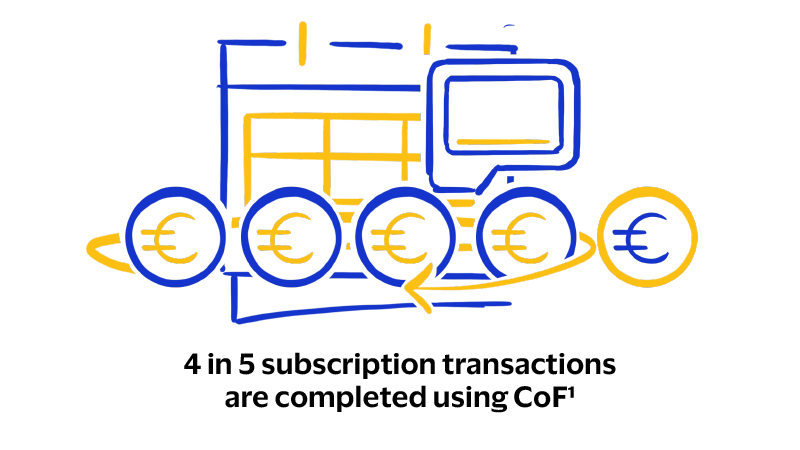

Simultaneously, consumers are showing their growing preference for using Card on File (CoF) solutions. It helps reduce friction by removing the need for consumers to enter their details at checkout. Over 50% of Nordic consumers now save their credentials on file with a merchant, reaching as high as 74% in Sweden and Iceland.¹

-

-

This image features a bar graph showing the market size for ecommerce and Point of sale (POS) in 2022. It also provides market size projections for 2026. Figures are in billions of USD for Sweden, Norway, Denmark, and Finland.

Key projected changes are as follows:

The average Nordic Ecommerce market size will grow by 49% and average Nordic POS market size will grow by 19%.

The country-by-country bars show Sweden's ecommerce market size will grow from $39bn in 2022 to $59bn in 2026, an increase of 51%.

Their POS size will increase from $186bn in 2022, to 231bn in 2026, an increase of 24%.

Norway's ecommerce market size will grow from $23bn in 2022 to $36bn in 2026, an increase of 57%. Their POS size will increase from $149bn in 2022, to $164bn in 2026, an increase of 10%.

Denmark's ecommerce market size will grow from $31bn in 2022 to $45bn in 2026, an increase of 45%. Their POS size will increase from $116bn in 2022, to $135bn in 2026, an increase of 16%.

Finland's ecommerce market size will grow from $16bn in 2022 to $22bn in 2026, an increase of 38%. Their POS size will increase from $89bn in 2022, to $111bn in 2026, an increase of 25%.

Similar to Europe, fraud and checkout friction are key risks

Fraud

Like the rest of Europe, digital fraud has also been a key issue in the Nordics, where 80% of all value lost to fraud is from CNP channels.¹

Nordic consumers are experiencing fraud in a variety of ways, with the most common being their card details being stolen and having their bank account or digital wallet hacked.¹

Checkout friction

Despite the growing popularity of CoF, almost half of ecommerce transactions today continue to be made through the friction heavy manual entry process.¹

This journey consistently falls short of the speed, ease and convenience consumers are looking for.

What does this mean for payment enablers and merchants?

Considerations for payment enablers

The Nordic ecommerce market represents a significant opportunity for enablers to tap into a growing sector that embraces innovation.

However, to capitalise on this potential, they must address the challenges of fraud and checkout friction.

By offering a consistently secure and seamless payment experience, solution providers can establish trust - setting the stage for sustained growth and success in one of the world’s most digitally advanced markets.

Implications for merchant strategy

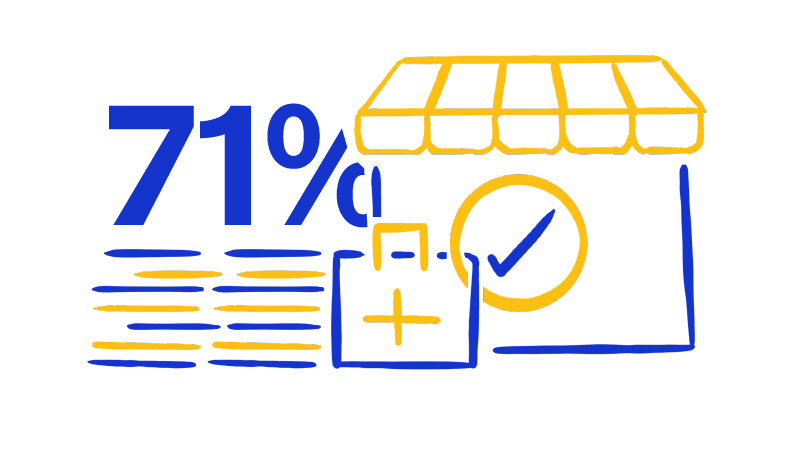

Merchants must keep up with rapidly evolving expectations. In particular, they will need to replicate and enhance the choice, security and trust consumers have with F2F.

Without chip-and-pin, merchants also need a solution that easily authenticates the customer, confirming they are who they claim to be.

And the entire end-to-end user experience needs to be as ‘invisible’ as possible, otherwise merchants will continue to face the risk and frustration of high basket abandonment.

The industry is already innovating with new emerging solutions that help solve these challenges and make life even better for merchants

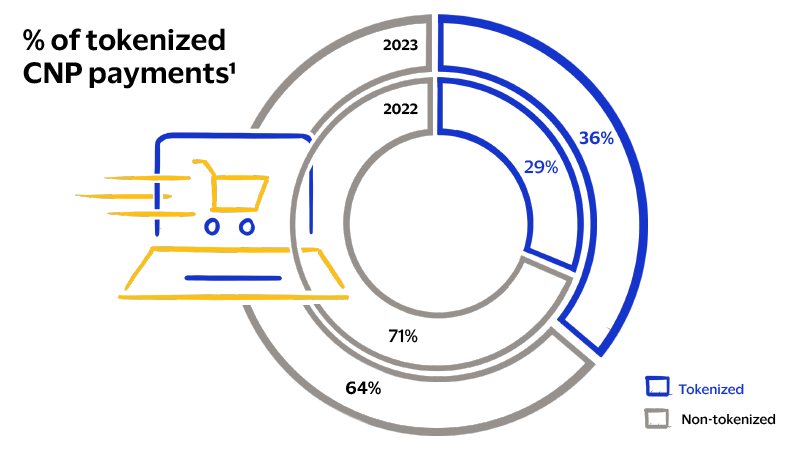

Network tokenization

As the popularity of CoF grows across the region, it’s becoming increasingly important to ensure consumer credentials are kept safe and secure.

Network tokenization addresses this issue as it protects sensitive cardholder details and enables a more seamless checkout experience.

When a consumer saves their card details online with a merchant, in a wallet, on their phone, or anywhere in the digital world, the PAN isn’t saved – a token is, instead.

-

-

This image shows a circular donut graph illustrating the percentage of tokenized versus non-tokenized Card Not Present (CNP) payments for the years 2022 and 2023. It depicts how in 2022, 29% of CNP payments in the Nordics were tokenized, whilst 71% were not, and in 2023 it shows how 36% of CNP payments were tokenized, whilst 64% were not.

Unique, tamper proof,

and secure

The token will only work when making a payment at the specific merchant it’s registered with.

Flexibility to cater

for all schemes

Tokens can work across all payment schemes to help deliver a consistent checkout experience.

A foundation for

payment innovation

Tokens can be integrated with several other digital solutions to help enhance the overall online checkout experience.

For these reasons, tokens are fast becoming a must have capability across the industry.

Sources:

1. Visa Nordic Digital Payments Study, 2023.

2. Decoding the European Mobile Wallet Evolution, Visa, 2023.

3. FIS Global Payments Report, 2023.

4. Global VBS SMB Strategy Refresh, SMB Trend Pack Compendium, Conducted by KoreFusion, Commissioned by Visa, August 2022.

5. Visa 2022 fraud data.

6. UK consumers expect fast and frictionless payment journeys, Tink, May 2022.

7. Number of open banking third party provider (TPP) registrations in Europe as of the 2nd quarter 2023, by country, Statista, 2024.

8. Visa European Mobile Wallet Evolution Study 2023.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC

The Click to Pay icon (or alternatively) is a trademark owned by and used with permission of EMVCo, LLC.

Case studies, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa Inc. does not make any warranty or representation as to the completeness or accuracy of the Information within this document, nor assume any liability or responsibility that may result from reliance on such Information. The Information contained herein is not intended as legal advice, and readers are encouraged to seek the advice of a competent legal professional where such advice is required.